7501 Wisconsin Avenue, Suite 1500E

Bethesda, Maryland 20814-6522

(301) 986-6200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 11, 201817, 2024

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of SAUL CENTERS, INC., a Maryland corporation (the “Company”), will be held at 11:00 a.m. local time, on May 11, 2018,17, 2024, at the Hyatt Regency Bethesda, One Bethesda Metro Center, Bethesda, MDMaryland (at the southwest corner of the intersection of Wisconsin Avenue and Old Georgetown Road, intersection, adjacent to the Bethesda station on the Metro Red Line), for the following purposes:

1.To elect five directors to serve until the annual meeting of stockholders in 2027, or until their successors are duly elected and qualified.

2.To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

3.To approve the Company's 2024 Stock Incentive Plan.

4.To approve an amendment to our charter to increase the number of authorized shares of common stock of the Company, par value $0.01 per share (“Common Stock”), from 40 million to 50 million shares and increase the number of authorized shares of excess stock, par value $0.01 per share, from 41 million to 51 million shares.

5.To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

Common stockholders of record at the close of business on March 1, 20184, 2024, will be entitled to notice of and to vote at the annual meeting or at any adjournment thereof. Holders of depositary shares representing interests in preferred stock are not entitled to receive notice of, and to vote at, the annual meeting.

Stockholders are cordially invited to attend the meeting in person. WHETHER OR NOT YOU NOW PLAN TO ATTEND THE MEETING, YOU ARE ASKED TO COMPLETE, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY CARD FOR WHICH A POSTAGE PAID RETURN ENVELOPE IS PROVIDED. If you decide to attend the meeting, you may revoke your proxy and vote your shares in person. It is important that your shares be voted.

| By Order of the Board of Directors | ||

| Bettina T. Guevara | ||

Chief and Secretary | ||

Bethesda, Maryland

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 11, 201817, 2024

The 20182024 Proxy Statement and 20172023 Annual Report to Stockholders are available at www.saulcenters.com

[This page intentionally left blank.]

7501 Wisconsin Avenue, Suite 1500E

Bethesda, Maryland 20814-5522

(301) 986-6200

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

MAY 11, 201817, 2024

GENERAL

This Proxy Statement is furnished by the Board of Directors (which we sometimes refer to as the “Board”) of Saul Centers, Inc. (the “Company”) in connection with the solicitation by the Board of Directors of proxies to be voted at the annual meeting of stockholders to be held on May 11, 2018,17, 2024, and at any adjournment or adjournments thereof, for the purposes set forth in the accompanying notice of such meeting. All common stockholders of record at the close of business on March 1, 20184, 2024, will be entitled to vote.

Any proxy, if received in time, properly signed and not revoked, will be voted at such meeting in accordance with the directions of the stockholder. If no directions are specified, the proxy will be voted for the Proposalsproposals set forth in this Proxy Statement. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. A proxy may be revoked (i) by delivery of a written statement to the Secretary of the Company stating that the proxy is revoked, (ii) by presentation at the annual meeting of a subsequent proxy executed by the person executing the prior proxy, or (iii) by attendance at the annual meeting and voting in person.

Votes cast in person or by proxy at the annual meeting will be tabulated, and a determination will be made as to whether or not a quorum is present. The Company will treat abstentions as shares that are present for purposes of determining the presence or absence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders. If a broker submits a proxy indicating that it does not have discretionary authority as to certain shares to vote on a particular matter (broker non-votes), those shares will be considered as present for purposes of determining the presence or absence of a quorum. The presence at the annual meeting, in person or by proxy, of holders of a majority of shares entitled to be cast will constitute a quorum for the transaction of business at the annual meeting.

For Proposal 1, the threefive nominees for director who receive the most votes will be elected. If a stockholder indicates “withhold authority to vote” for a particular nominee on the stockholder’s proxy card, the stockholder’s vote will not count either for or against the nominee. Any shares not voted as a result of an abstention or a broker non-vote will have no impact on the vote for Proposal 1. For Proposal 2, the affirmative vote of a majority of the votes cast on the proposal is required to ratify the appointment of the Company’s independent registered public accounting firm. Any shares not voted as a result of an abstention or a broker non-vote will have no impact on the vote for Proposal 2. For Proposal 3, the affirmative vote of a majority of the votes cast on the proposal is required to approve the 2024 Stock Incentive Plan. However, because stockholder approval of the 2024 Stock Incentive Plan is required under New York Stock Exchange (“NYSE”) listing standards and because the NYSE treats abstentions as votes cast, if you abstain from voting on Proposal 3, the abstention will have the effect of a vote against such proposal. For Proposal 4, the affirmative vote of two-thirds of the votes entitled to be cast is required to approve the amendment to our charter. For Proposal 4, any shares not voted as a result of an abstention or a broker non-vote will effectively be treated as a vote against the proposal.

Solicitation of proxies will be primarily by mail. However, directors and officers of the Company also may solicit proxies in person, by telephone, by email, through press releases issued by the Company, or telegram or in person.through postings on the Company's website. All of the expenses of preparing, assembling, printing and mailing the materials used in the solicitation of proxies will be paid by the Company. Arrangements may be made with brokering houses and other custodians, nominees and fiduciaries to forward soliciting materials, at the expense of the Company, to the beneficial owners of shares held of record by such persons. It is anticipated that this Proxy Statement and the enclosed proxy card will first will be mailed to common stockholders on or about March 23, 2018.April 5, 2024. Proxy materials are also available at www.saulcenters.com.

As of the record date, March 1, 2018, 22,020,2794, 2024, 23,981,695 shares of Common Stock were issued, outstanding and eligible to vote. Each share of Common Stock entitles the holder thereof to one vote on each of the matters to be voted upon at the annual meeting. Holders of depositary shares representing interests in preferred stock are not entitled to receive notice of, and to vote at, the annual meeting. As of the record date, officers and directors of the Company had the power to vote approximately 45.6% 48.6%

1

of the issued and outstanding shares of Common Stock. The Company’s officers and directors have advised the Company that they intend to vote their shares of Common Stock in favor of the Proposalsproposals set forth in this Proxy Statement.

The U. S. Securities and Exchange Commission’s (“SEC”) rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. We have delivered only one Proxy Statement, or annual report, as applicable, to multiple stockholders who share an address, unless we received contrary instructions from any of the impacted stockholders prior to the mailing date. We will promptly deliver, upon written or oral request, a separate copy of the Proxy Statement, or annual report, as applicable, to any stockholder at a shared address to which a single copy of those documents was delivered. In the future, if you prefer to receive separate copies of the Proxy Statement or annual report, as applicable, contact the Company at 7501 Wisconsin Avenue, Suite 1500E, Bethesda, Maryland 20814-6522, Attn: Secretary or (301) 986-6200. If you are currently a stockholder sharing an address with another stockholder and are receiving more than one Proxy Statement or annual report, as applicable, and wish to receive only one copy of future proxy statements or annual reports, as applicable, for your household, please contact the Company at the above phone number or address.

PROPOSALS TO BE PRESENTED AT THE ANNUAL MEETING

The Company will present the following proposals at the annual meeting. The Company has described in this proxy statement all the proposals that it expects will be made at the annual meeting. If a stockholder or the Company properly presents any other proposal to the meeting after March 23, 2018,April 2, 2024, the Company will, to the extent permitted by applicable law, use the stockholder’s proxies to vote shares on the proposal in the Company’s best judgment.

1.Election of Directors

The Articles of Incorporation of the Company ("Articles") and the Amended and Restated Bylaws of the Company as amended (“Bylaws”), provide that there shall be no fewer than three, nor more than 15 directors, as determined from time to time by the directors in office. The Board of Directors of the Company currently consists of 12 directors divided into three classes with staggered three-year terms. Upon recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has proposed to increase the size of the Board of Directors to 13 members effective at the annual meeting. The term of each class expires at thean annual meeting of stockholders, which is expected to be held in the spring of each year. Each director elected at the annual meeting of stockholders in 20182024 will serve until the annual meeting of stockholders in 20212027 or until his or her replacement is elected and qualifies or until his or her earlier resignation or removal.

The nominees for election to the Board of Directors are:

Philip D. Caraci

Willoughby B. Laycock

LaSalle D. Leffall III

Earl A. Powell III

Mark Sullivan III

Except for Mr. Leffall III, each of the nominees is presently a member of the Board of Directors and hasDirectors. All nominees have consented to serve as a director if re-elected.elected. More detailed information about each of the nominees is available in the section of this proxy statement titled “The Board of Directors,” which begins on page three.10. If any of the nominees cannot serve for any reason (which is not anticipated), the Board of Directors, upon recommendation of its Nominating and Corporate Governance Committee, may designate a substitute nominee or nominees. If a substitute is nominated, the Company will vote all valid proxies for the election of the substitute nominee or nominees. The Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee, may also decide to leave the boardBoard seat or seats open until a suitable candidate or candidates are located, or it may decide to reduce the size of the Board. Proxies for the annual meeting may not be voted for more than threefive nominees.

The Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee, unanimously recommends that you vote FOR each of these directors.

2.Ratification of Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2018the fiscal year ending December 31, 2024

The firmAudit Committee of Ernstthe Board has appointed Deloitte & YoungTouche LLP ("EY"(“Deloitte”), an as the Company's independent registered public accounting firm audited our consolidated financial statements for the years ended December 31, 2017 and 2016. On March 5, 2018, the Audit Committee of the Board elected to replace EY and appoint Deloitte & Touche LLP ("Deloitte") to audit our consolidated financial statements for the year ending December 31, 2018.

2024. Services provided to the Company by EYDeloitte in 20172023 are described under “2017“2023 and 20162022 Independent Registered Public Accounting Firm Fee Summary” on page 21.

33.

Stockholder ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for 20182024 is not required by the Articles, Bylaws or otherwise. However, the Board of Directors is submitting the appointment of Deloitte to the stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the

2

selection, the Audit Committee will reconsider whether or not to retain the firm. In such event, the Audit Committee may retain Deloitte, notwithstanding the fact that the stockholders did not ratify the selection, or select another accounting firm without

re-submitting the matter to the stockholders. Even if the selection is ratified, the Audit Committee reserves the right at its discretion to select a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Representatives of Deloitte will be present at the annual meeting to respond to appropriate questions and to make such statements as they may desire.

The Board of Directors, upon recommendation of the Audit Committee, unanimously recommends that you vote FOR the ratification of Deloitte as the Company’s independent registered public accounting firm for 2018.2024.

We are seeking stockholder approval of the Saul Centers, Inc. 2024 Stock Incentive Plan (the “2024 Plan” or the “Plan”), which the Board of Directors adopted on September 21, 2023 upon the recommendation of the Compensation Committee. The Plan will only become effective if approved by stockholders at the annual meeting. If approved, the effective date of the Plan will be May 17, 2024.

If approved, the Plan will enable the Company to provide stock-based incentives that align the interests of employees, consultants and outside directors with those of the stockholders of the Company by motivating its employees to achieve long-term results and rewarding them for their achievements, and to attract and retain the types of employees, consultants and outside directors who will contribute to the Company’s long-range success.

The Company believes that equity-based compensation is a critical part of its compensation program. Stockholder approval of the Plan would allow us to continue to attract and retain talented employees, consultants and directors with equity incentives.

Overview

The Plan is intended to be the successor to the Saul Centers, Inc. 2004 Stock Plan, as amended (the “2004 Plan” or the “Predecessor Plan”). From and after May 17, 2024, no additional awards will be granted under the Predecessor Plan and all outstanding awards granted under the Predecessor Plan will remain subject to the terms of the Predecessor Plan.

On September 21, 2023, the Board of Directors approved the Plan, subject to stockholder approval.

If stockholders approve this proposal, the Plan will become effective as of the date of stockholder approval. If stockholders do not approve this proposal, the Plan will not take effect and the Predecessor Plan will continue to be administered in its current form until its termination (or until such time as there are no more shares available for issuance under the Plan, whichever occurs first). Following the expiration or termination of the Predecessor Plan, we will be unable to maintain our current equity grant practices and, therefore, we will be at a significant competitive disadvantage in attracting, motivating and retaining talented individuals who contribute to our success. We will also be compelled to replace long-term incentive awards with cash awards, which may not align the interests of our executives and employees with those of our stockholders as effectively as equity incentive awards.

Shares Available for Future Awards

As of February 29, 2024, 125,812 shares remained available for grant under the Predecessor Plan. In determining the number of shares requested for authorization under the Plan, the Board of Directors and the Compensation Committee carefully considered our anticipated future equity needs, our historical equity compensation practices (including our historical “burn rate,” as discussed below). The maximum aggregate number of shares authorized for issuance under the Plan is 2,000,000 (two million).

As of February 29, 2024, 1,937,382 equity awards were outstanding under the Predecessor Plan, comprised of 1,820,000 options to purchase shares (with a weighted average exercise price of $49.41 and a weighted average remaining term of five (5) years), and 117,382 shares credited to the deferred stock accounts of directors pursuant to the Deferred Compensation Plan for Directors in respect of fees paid by the Company to directors.

Considerations for the Approval of the Plan

The following is a list of some of the primary factors to be considered by stockholders in connection with approving adoption of the Plan:

3

Governance Best Practices

The Plan incorporates the following corporate governance best practices that align our equity compensation program with the interests of our stockholders:

•No evergreen provision. The Plan does not contain an “evergreen” feature pursuant to which the shares authorized for issuance under the plan can be increased automatically without stockholder approval.

•Clawback of awards. Under certain circumstances, awards granted under the Plan are subject to clawback and recoupment rights that the Company has under the Plan and to the extent required by law.

•No discounted stock options or stock appreciation rights. Stock options and stock appreciation rights may not be granted with a per share exercise price less than 100% of fair market value on the date of grant.

•No tax gross-ups. No participant is entitled under the Plan to any tax gross-up payments for any excise tax pursuant to Section 280G or 4999 of the Internal Revenue Code of 1986, as amended (the “Code”) that may be incurred in connection with awards under the Plan.

•Limit on non-employee director compensation. The Plan limits the maximum compensation, including cash and equity, that may be paid to any individual for service as an outside director to no more than $350,000 per year, or in a year in which the outside director is first appointed or elected to our Board of Directors to no more than $500,000.

Modest Share Usage and Stockholder Dilution

•When determining the number of shares authorized for issuance under the Plan, the Board of Directors and the Compensation Committee carefully considered the potential dilution to our current stockholders as measured by our “burn rate,” “overhang” and projected future share usage.

•Our three-year average burn rate is 1.1%. This demonstrates our sound approach to the grant of equity incentive compensation and our commitment to aligning our equity compensation program with the interests of our stockholders.

| Year | Total Shares Granted (#) | Basic Weighted Avg. Shares Outstanding (#) | Burn Rate (%) (a) | |||||||||||

| 2021 | 261,112 | 23,655,605 | 1.1% | |||||||||||

| 2022 | 258,522 | 23,968,926 | 1.1% | |||||||||||

| 2023 | 266,663 | 24,051,102 | 1.1% | |||||||||||

| 2024 (projected) | (b) | 270,000 | 24,091,073 | 1.1% | ||||||||||

(a)Annual share usage or “burn rate” is determined by dividing total awards granted by the basic weighted average shares outstanding.

(b) Represents weighted average shares outstanding from January 1, 2024 to February 29, 2024.

Modest Stockholder Dilution

•We are committed to limiting stockholder dilution from our equity compensation programs. If the Plan is approved by our stockholders, our overhang would be 16.4%. We calculate “overhang” as the total of (i) shares underlying outstanding awards at target plus shares available for issuance for future awards, divided by (ii) the total number of shares outstanding.

| Stock Options | |||||||||||||||||||||||||||||

| As of | Number Outstanding | Weighted Average Exercise Price ($) | Weighted Average Remaining Term | Total Full Value Awards Outstanding | Shares Available | Total Shares Within Plans | Shares Outstanding | Diluted Shares Outstanding | Total Equity Dilution | ||||||||||||||||||||

| February 29, 2024 | 1,820,000 | $49.41 | 5 Years | 117,382 | 125,812 | 2,063,194 | 23,981,695 | 26,044,889 | 7.9% | ||||||||||||||||||||

| Additional Shares Requested | 2,000,000 | ||||||||||||||||||||||||||||

| February 29, 2024 (a) | 1,820,000 | $49.41 | 5 Years | 117,382 | 2,000,000 | 3,937,382 | 23,981,695 | 27,919,077 | 14.1% | ||||||||||||||||||||

(a)Adjusted for proposed increase.

4

•Based on our conservative usage of shares authorized for issuance under the Predecessor Plan to date and our reasonable expectation of future equity usage under the Plan, we believe that the number of additional shares being requested for authorization under the Plan will last at least five (5) years. This estimate is based on a forecast that reflects our current practices under our executive compensation program, an estimated range of our stock price over time, and our historical forfeiture rates.

Attract and Retain Talent

•We grant long-term incentive awards to our executives and employees. Approving the Plan will enable us to continue to recruit, retain and motivate top talent at many levels within our Company, which is necessary for our success.

Summary Description of the Plan

The following is only a summary of the Plan, and is qualified in its entirety by reference to its full text, a copy of which is attached as Annex A. Capitalized terms in this summary that are not defined have the meaning as provided in the Plan.

Stock Awards. The Plan provides for the grant of incentive stock options (“ISOs”), nonstatutory stock options (“NSOs”), restricted share awards, stock unit awards, stock appreciation rights, other stock-based awards, performance-based stock awards (collectively, “stock awards”) and cash-based awards (stock awards and cash-based awards are collectively referred to as “awards”). ISOs may be granted only to our employees, including officers, and the employees of our parent or subsidiaries. All other awards may be granted to our employees, officers, outside directors, and consultants and the employees and consultants of our subsidiaries and affiliates.

Share Reserve. The aggregate number of shares that may be issued pursuant to stock awards under the Plan will not exceed 2,000,000 (two million) shares.

If restricted shares or shares issued upon the exercise of options are forfeited, then such shares will again become available for awards under the Plan. If stock units, options, or stock appreciation rights are forfeited or terminate for any reason before being exercised or settled, or an award is settled in cash without the delivery of shares to the holder, then the corresponding shares will again become available for awards under the Plan. Any shares withheld to satisfy the exercise price or tax withholding obligation pursuant to any award of options or stock appreciation rights will again become available for awards under the Plan. If stock units or stock appreciation rights are settled, then only the number of shares (if any) actually issued in settlement of such stock units or stock appreciation rights will reduce the number of shares available under the Plan, and the balance (including any shares withheld to cover taxes) will again become available for awards under the Plan.

Shares issued under the Plan will be authorized but unissued shares. As of the date hereof, no awards have been granted and no shares have been issued under the Plan.

Incentive Stock Option Limit. The maximum number of shares that may be issued upon the exercise of ISOs under the Plan is equal to five (5) times the Plan’s share reserve as described above under the heading “—Share Reserve”, plus, to the extent allowable under Section 422 of the Code, any shares that become available for issuance under the Plan on account of (i) an award being forfeited before all underlying shares have been issued or settled, or (ii) a portion of the shares underlying an award being withheld to satisfy the exercise price or tax withholding of such award.

Grants to Outside Directors. The sum of (i) the grant date fair value for financial reporting purposes of any awards granted during any calendar year under the Plan to an outside director as compensation for services as an outside director and (ii) any cash fees paid by us to such outside director during such calendar year for service on our board of directors, may not exceed three hundred and fifty thousand dollars ($350,000), or, in the calendar year in which the outside director is first appointed or elected to our board of directors, five hundred thousand dollars ($500,000).

Administration.The Plan will be administered by the Compensation Committee. Subject to the limitations set forth in the Plan, the Compensation Committee will have the authority to determine, among other things, to whom awards will be granted, the number of shares subject to awards, the term during which a stock option or stock appreciation right may be exercised and the rate at which the awards may vest or be earned, including any performance criteria to which they may be subject. The Compensation Committee also will have the authority to determine the consideration and methodology of payment for awards.

Repricing; Cancellation and Re-Grant of Stock Awards. The Compensation Committee will have the authority to modify outstanding awards under the Plan. Subject to the terms of the Plan, the Compensation Committee will have the authority to cancel any outstanding stock award in exchange for new stock awards, including awards having the same or a different exercise price cash, or other consideration, without stockholder approval but with the consent of any adversely affected recipient.

5

Stock Options. A stock option is the right to purchase a certain number of shares, at a certain exercise price, in the future. Under the Plan, ISOs and NSOs are granted pursuant to stock option agreements adopted by the Compensation Committee. The Compensation Committee determines the exercise price for a stock option, within the terms and conditions of the Plan, provided that the exercise price of a stock option generally cannot be less than one hundred percent (100%) of the fair market value of a share on the date of grant. Options granted under the Plan vest at the rate specified by the Compensation Committee.

Stock options granted under the Plan generally must be exercised by the recipient before the earlier of the expiration of such stock option or the expiration of a specified period following the recipient’s termination of employment. The Compensation Committee determines the term of the stock options up to a maximum of ten (10) years. Each stock option agreement will set forth the extent to which the recipient will have the right to exercise the stock option following the termination of the recipient’s service with us (or our subsidiaries or affiliates), and the right to exercise the stock option of any executors or administrators of the recipient’s estate or any person who has acquired such options directly from the recipient by bequest or inheritance.

Payment of the exercise price may be made in cash or, if provided for in the stock option agreement evidencing the award, (1) by surrendering, or attesting to the ownership of, shares that have already been owned by the recipient, (2) future services or services rendered to us, our subsidiaries or affiliates prior to the award, (3) by delivery of an irrevocable direction to a securities broker to sell shares and to deliver all or part of the sale proceeds to us in payment of the aggregate exercise price, (4) by delivery of an irrevocable direction to a securities broker or lender to pledge shares and to deliver all or part of the loan proceeds to us in payment of the aggregate exercise price, (5) by a “net exercise” arrangement, (6) by delivering a full-recourse promissory note, or (7) by any other form that is consistent with applicable laws, regulations, and rules.

Tax Limitations on Incentive Stock Options. The aggregate fair market value, determined at the time of grant, of our shares with respect to ISOs that are exercisable for the first time by a recipient during any calendar year under all of our stock plans may not exceed $100,000. Stock options or portions thereof that exceed such limit will generally be treated as NSOs. No ISO may be granted to any person who, at the time of the grant, owns or is deemed to own shares of capital stock possessing more than ten percent (10%) of our total combined voting power or that of any of our affiliates unless (1) the stock option exercise price is at least one hundred ten percent (110%) of the fair market value of the shares subject to the stock option on the date of grant, and (2) the term of the ISO does not exceed five (5) years from the date of grant.

Restricted Share Awards.The terms of any awards of restricted shares under the Plan will be set forth in a restricted share agreement to be entered into between us and the recipient. The Compensation Committee will determine the terms and conditions of the restricted share agreements, which need not be identical. A restricted share award may be subject to vesting requirements or transfer restrictions or both. Restricted shares may be issued for such consideration as the Compensation Committee may determine, including cash, cash equivalents, full recourse promissory notes, past services and future services. Award recipients who are granted restricted shares generally have all the rights of a stockholder with respect to those shares, provided that dividends and other distributions will not be paid in respect of unvested shares unless otherwise determined by the Compensation Committee and, in such case, only once such unvested shares vest.

Stock Unit Awards. Stock unit awards give recipients the right to acquire a specified number of shares (or cash amount) at a future date upon the satisfaction of certain conditions, including any vesting arrangement, established by the Compensation Committee and as set forth in a stock unit award agreement. A stock unit award may be settled by cash, delivery of shares, or a combination of cash and shares as deemed appropriate by the Compensation Committee. Recipients of stock unit awards generally will have no voting or dividend rights prior to the time the vesting conditions are satisfied and the award is settled. At the Compensation Committee’s discretion and as set forth in the stock unit award agreement, stock units may provide for the right to dividend equivalents. Dividend equivalents may not be distributed prior to settlement of the stock unit to which the dividend equivalents pertain and the value of any dividend equivalents payable or distributable with respect to any unvested stock units that do not vest will be forfeited.

StockAppreciation Rights. Stock appreciation rights generally provide for payments to the recipient based upon increases in the price of a share over the exercise price of the stock appreciation right. The Compensation Committee determines the exercise price for a stock appreciation right, which generally cannot be less than one hundred percent (100%) of the fair market value of our shares on the date of grant. A stock appreciation right granted under the Plan vests at the rate specified in the stock appreciation right agreement as determined by the Compensation Committee. The Compensation Committee determines the term of stock appreciation rights granted under the Plan, up to a maximum of ten (10) years. Upon the exercise of a stock appreciation right, we will pay the recipient an amount in shares, cash, or a combination of shares and cash as determined by the Compensation Committee, equal to the product of (1) the excess of the per share fair market value on the date of exercise over the exercise price, multiplied by (2) the number of shares with respect to which the stock appreciation right is exercised.

6

Other Stock Awards.The Compensation Committee may grant other awards based in whole or in part by reference to our shares. The Compensation Committee will set the number of shares under the stock award and all other terms and conditions of such awards.

Cash-Based Awards. A cash-based award is denominated in cash. The Compensation Committee may grant cash-based awards in such number and upon such terms as it will determine. Payment, if any, will be made in accordance with the terms of the award, and may be made in cash or in shares, as determined by the Compensation Committee.

Performance-Based Awards. The number of shares or other benefits granted, issued, retainable and/or vested under a stock or stock unit award may be made subject to the attainment of performance goals. The Compensation Committee may utilize any performance criteria selected by it in its sole discretion to establish performance goals.

Changes to Capital Structure. In the event of a recapitalization, stock split, or similar capital transaction, the Compensation Committee will make appropriate and equitable adjustments to the number of shares reserved for issuance under the Plan, the number of shares that can be issued as ISOs, the number of shares subject to outstanding awards and the exercise price under each outstanding stock option or stock appreciation right.

Transactions. If we are involved in a merger or other reorganization, outstanding awards will be subject to the agreement of merger or reorganization. Subject to compliance with applicable tax laws, such agreement may provide, without limitation, for (1) the continuation of the outstanding awards by us, if we are a surviving corporation, (2) the assumption or substitution of the outstanding awards by the surviving corporation or its parent or subsidiary, (3) the immediate vesting, exercisability, and settlement of the outstanding awards followed by their cancellation, (4) cancellation of the award, to the extent not vested or not exercised prior to the effective time of the merger or reorganization, in exchange for such cash or equity consideration (including no consideration) as the Compensation Committee, in its sole discretion, may consider appropriate, or (5) the settlement of the intrinsic value of the outstanding awards (whether or not vested or exercisable) in cash, cash equivalents, or equity (including cash or equity subject to deferred vesting and delivery consistent with the vesting restrictions applicable to such award or the underlying shares) followed by cancellation of such awards, provided that any such amount may be delayed to the same extent that payment of consideration to the holders of shares in connection with the merger or reorganization is delayed as a result of escrows, earnouts, holdbacks or other contingencies.

Change of Control. The Compensation Committee may provide, in an individual award agreement or in any other written agreement between a recipient and us, that the award will be subject to acceleration of vesting and exercisability in the event of a change of control.

Transferability.Unless the Compensation Committee provides otherwise, no award granted under the Plan may be transferred in any manner (prior to the vesting and lapse of any and all restrictions applicable to shares issued under such award), except by will, the laws of descent and distribution, or pursuant to a domestic relations order, provided that all ISOs may only be transferred or assigned only to the extent consistent with Section 422 of the Code.

Amendment and Termination.Our Board of Directors will have the authority to amend, suspend, or terminate the Plan, provided that such action does not materially impair the existing rights of any recipient without such recipient’s written consent.

No ISOs may be granted more than ten (10) years after years after the later of (i) the approval of the Plan by the Board of Directors (or, if earlier, the stockholders) and (ii) the approval by the Board of Directors (or, if earlier, the stockholders) of any amendment to the Plan that constitutes the adoption of a new plan for purposes of Section 422 of the Code.

Recoupment.To the extent permitted by applicable law, the Compensation Committee will have the authority to require that, in the event that we are required to prepare restated financial results owing to an executive officer’s intentional misconduct or grossly negligent conduct, such executive officer will reimburse or forfeit to us the amount of any bonus or incentive compensation (whether cash-based or equity-based) such executive officer received during a fixed period, as determined by the Compensation Committee, preceding the year the restatement is determined to be required. That executive officer will forfeit or reimburse to us any bonus or incentive compensation to the extent that such bonus or incentive compensation exceeds what the officer would have received in that period based on an applicable restated performance measure or target. We will also recoup incentive-based compensation in accordance with Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), Section 303A.14 of the NYSE listing standards and any other rules, regulations and/or listing standards that may be issued under the Dodd-Frank Act or by the SEC or the NYSE.

7

Certain Federal Income Tax Aspects of Awards Under the Plan

This is a brief summary of the federal income tax aspects of awards that may be made under the Plan based on existing U.S. federal income tax laws. This summary provides only the basic tax rules. It does not describe a number of special tax rules, including the alternative minimum tax and various elections that may be applicable under certain circumstances. It also does not reflect provisions of the income tax laws of any municipality, state or foreign country in which a holder may reside, nor does it reflect the tax consequences of a holder’s death. The tax consequences of awards under the Plan depend upon the type of award.

Incentive Stock Options. The recipient of an ISO generally will not be taxed upon grant of the ISO. Federal income taxes are generally imposed only when the shares from exercised ISOs are disposed of, by sale or otherwise. The amount by which the fair market value of the shares on the date of exercise exceeds the exercise price is, however, included in determining the recipient’s liability for the alternative minimum tax. If the recipient does not sell or dispose of the shares until more than one (1) year after the receipt of the shares and two (2) years after the ISO was granted, then, upon sale or disposition of the shares, the difference between the exercise price and the market value of the shares as of the date of exercise will be treated as a long-term capital gain, and not ordinary income. If a recipient fails to hold the shares for the minimum required time the recipient will recognize ordinary income in the year of disposition generally in an amount equal to any excess of the market value of the shares on the date of exercise (or, if less, the amount realized or disposition of the shares) over the exercise price paid for the shares. Any further gain (or loss) realized by the recipient generally will be taxed as short-term or long-term gain (or loss) depending on the holding period. The Company will generally be entitled to a tax deduction at the same time and in the same amount as ordinary income is recognized by the recipient.

Nonstatutory Stock Options. The recipient of stock options not qualifying as ISOs generally will not be taxed upon the grant of the stock option. Federal income taxes are generally due from a recipient of nonstatutory stock options when the stock options are exercised. The excess of the fair market value of the shares purchased on such date over the exercise price of the stock option is taxed as ordinary income. Thereafter, the tax basis for the acquired shares is equal to the amount paid for the shares plus the amount of ordinary income recognized by the recipient. We will generally be entitled to a tax deduction at the same time and in the same amount as ordinary income is recognized by the recipient by reason of the exercise of the stock option.

Other Awards. Recipients who receive restricted stock unit awards will generally recognize ordinary income when they receive shares upon settlement of the awards in an amount equal to the fair market value of the shares at that time. Recipients who receive awards of restricted shares subject to a vesting requirement will generally recognize ordinary income at the time vesting occurs in an amount equal to the fair market value of the shares at that time minus the amount, if any, paid for the shares. Recipients who receive stock appreciation rights will generally recognize ordinary income upon exercise in an amount equal to the excess of the fair market value of the underlying shares on the exercise date over the exercise price. We will generally be entitled to a tax deduction at the same time and in the same amount as ordinary income is recognized by the recipient.

Information Regarding Plan Benefits

As described above, the Compensation Committee, in its discretion, will select who receives awards and the size and type of those awards under the Plan, if the Plan is approved by our stockholders. Therefore, the awards that will be made to particular recipients in the future under the Plan are not determinable at this time. Information regarding awards granted to our named executive officers and directors under the Predecessor Plan during the year ended December 31, 2023 may be found under the captions “Compensation Discussion and Analysis” and “Compensation of Directors”. In addition, see “Equity Compensation Plan Information” for information with respect to our equity compensation plans as of December 31, 2023.

The Board of Directors recommends a vote FOR the approval of the Company’s 2024 Stock Incentive Plan.

4. Approval of an Amendment to Our Articles to Increase the Number of Authorized Shares of Common Stock.

Upon the recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has unanimously approved and directed that there be submitted to the Company’s stockholders for their approval a proposal to amend the Articles to increase the number of authorized shares, including the number of authorized shares of Common Stock from 40.0 million shares to 50.0 million shares and the number of authorized shares of excess stock from 41.0 million shares to 51.0 million shares. The text of the proposed amendment is set forth in Annex B.

Purpose and Effect of Amendment

The Board of Directors recommends an increase in the number of authorized shares of Common Stock to ensure that the Company has a sufficient reserve of shares to meet its current and future needs. The Company has not sought shareholder approval for an increase in the number of authorized shares of Common Stock for ten (10) years. The Board of Directors believes that having a sufficient number of authorized but unissued shares of Common Stock available provides the Company

8

greater operational flexibility through various means, including equity issuances in connection with underwritten public offerings, our Dividend Reinvestment and Stock Purchase Plan (the “DRIP”), mergers or acquisitions or other corporate purposes. In addition, Saul Holdings Limited Partnership, which serves as our operating partnership, may issue limited partnership units in connection with property acquisitions or pursuant to its unit reinvestment plan. In general, these units are convertible into shares of Common Stock on a one-for-one basis. As a real estate investment trust (“REIT”) we cannot retain earnings, and therefore access to additional capital and capital markets is critical to our growth.

Under the existing Articles, the Company is authorized to issue up to 40.0 million shares of Common Stock, of which approximately 24.0 million shares of Common Stock are currently issued and outstanding. The outstanding convertible limited partnership units in our operating partnership could potentially require the issuance of approximately 10.4 million shares of Common Stock. Additionally, the Company has reserved (a) an additional 2.0 million shares of Common Stock for future issuance under its DRIP and (b) approximately 1.9 million shares of Common Stock for future issuance pursuant to the Predecessor Plan, and, assuming Proposal 3 is approved by the Company's stockholders, 2.0 million shares for future issuance under the Plan. Accordingly, the Board of Directors believes it is appropriate and in the best interests of the Company and the stockholders to increase the Company’s authorized shares of Common Stock at this time.

Stockholder approval of the proposed amendment would result in a substantial increase in the number of shares of Common Stock authorized for issuance under the Articles. If the stockholders approve the increase in shares, the Company may issue the additional shares of Common Stock from time to time for such purposes and consideration as the Board of Directors may approve, without further stockholder action.

The Board of Directors has also recommended a corresponding increase in the number of authorized shares of excess stock to ensure compliance with the stock ownership limits set forth in the Articles. The ownership limit helps safeguard the Company’s status as a REIT. If any stockholder acquires shares of common or preferred stock in excess of the ownership limit, the proposed increase would guarantee that the Company could issue a sufficient number of shares of excess stock to comply with these restrictions.

Rights of Additional Authorized Shares of Common Stock

The proposed additional shares of Common Stock would have rights identical to the shares of Common Stock currently outstanding. Approval of the proposal and issuance of the additional shares of Common Stock would not affect the rights of the current stockholders, except for incidental effects related to an overall increase in the total number of shares of Common Stock outstanding, including the dilution of the earnings per share and voting rights of current stockholders.

Potential Adverse Effects of Amendment

The existence of a large number of authorized but unissued shares of Common Stock could hinder a takeover of the Company without further action by the stockholders. If this proposal is approved, the Company will be able to issue additional shares of Common Stock. Also, the Board of Directors will have greater flexibility in responding to a merger or acquisition bid, for example, by placing blocks of shares with persons friendly to the Company, or by taking other steps to prevent an acquisition of the Company under circumstances that the Board of Directors does not believe to be in the Company’s best interest. The Board of Directors is not currently aware of any pending capital transactions, corporate acquisitions, takeover proposals or other similar events involving the Company. This proposal is not being presented with the intent that it be used to prevent or discourage any acquisition attempt.

Effectiveness of Amendment

The proposed amendment, if approved by stockholders, will become effective on the date such amendment is filed with the Maryland State Department of Assessments and Taxation. It is anticipated that the appropriate filing to effect the amendment will be made as soon after the annual meeting as practicable.

The Board of Directors unanimously recommends a vote FOR this proposal to amend the Articles to increase the number of authorized shares of Common Stock and excess stock.

9

THE BOARD OF DIRECTORS AND DIRECTOR NOMINEES

The following table and biographical descriptions set forth for each nominee and director, the name, age, principal occupations and directorships held during at least the past five years for each nominee and director, directorships held within the last five years and the positions they currently hold with the Company. The biographical description below for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board that such person should serve as a director of the Company. The biographical description of each director who is not standing for election includes the specific experience, qualifications, attributes and skills that the Board would expect to consider if it were making a conclusion currently as to whether such person should serve as a director. The information is as of March 1, 2018 unless otherwise indicated.

14, 2024.

| Name | Age | ||||||||||||||

| Principal Occupation and Directorships | |||||||||||||||

| Class One Directors-Term Ends at | |||||||||||||||

| Philip D. Caraci | Vice Chairman since March 2003, Director since June 1993. President from 1993 to March B. F. Saul Real Estate Investment Trust from 1987 to 2003. Executive Vice President of the B. F. Saul Company from 1987 to 2003, with which he had been associated since 1972. President of B. F. Saul Property Company from 1986 to 2003. Trustee of the B. F. Saul Real Estate Investment Trust*. Through these experiences, Mr. Caraci contributes real estate expertise and familiarity with the Company’s business to the Board. | ||||||||||||||

| Willoughby B. Laycock | 36 | Director since March 2019. Senior Vice President, Residential Design and Market Research since September 2021. Senior Vice President, Residential Marketing from May 2019 to September 2021. Vice President, Residential Marketing from May 2018 to May 2019. Assistant Vice President, Residential Marketing from 2016 through 2018. Ms. Laycock previously worked as a financial analyst at Dalton Investments and Davis Advisors. Ms. Laycock is the granddaughter of the Company's Chairman and Chief Executive Officer, B. Francis Saul II, and the niece of Patricia Saul Lotuff and Andrew M. Saul II, members of the Board. Through these experiences, Ms. Laycock contributes financial acumen and multi-family marketing and development experience to the Board. | |||||||||||||

| LaSalle D. Leffall III | 61 | Director Nominee. Founder and Managing Member of LDL Financial LLC since 2006. President and Chief Operating Officer of The NHP Foundation from 2002 to 2006. Investment banker in mergers and acquisitions divisions of UBS and Credit Suisse from 1996 to 2002. Attorney at Cravath, Swaine & Moore from 1992 to 1996, advising on mergers and acquisitions transactions. Member of the Advisory Board of Cabot Properties, Inc. from 2020 through January 2024. Member of the Board of Directors and Compensation Committee of Cabot Properties, Inc. since January 2024. Member of the Board of Directors and Audit Committee of MoA Funds* since 2011. Member of Board of Directors, Chair of Finance Committee, and Vice Chair of Audit and Enterprise Risk Committees of Federal Home Loan Bank of Atlanta* from 2007 to 2020. Through these experiences, if elected, Mr. Leffall III will contribute finance, leadership, governance, and legal experience to the Board. | |||||||||||||

| Earl A. Powell III | Director since March 2018. Director Emeritus of the National Gallery of Art since Through these experiences, Mr. Powell contributes leadership, management and governance expertise to the Board. | ||||||||||||||

10

| Name | Age | Principal Occupation and Directorships | |||||||||||||

| Class One Directors-Term Ends at 2027 Annual Meeting (if elected) (Continued) | |||||||||||||||

| Mark Sullivan III | Director since April 2008, previously served as Director from 1997 through 2002. U.S. Executive Director of the European Bank for Reconstruction and Development from 2002 to April Through these experiences, Mr. Sullivan III contributes financial and legal expertise to the Board. | ||||||||||||||

| Name | Age | Principal Occupation and Directorships | ||||||||||||||

| Class Three Directors-Term Ends at | ||||||||||||||||

| B. Francis Saul II | Chairman, Chief Executive Officer and Director since June Mr. B. Francis Saul II is the father of Mr. Andrew M. Saul II and Ms. Patricia Saul Lotuff and the grandfather of Ms. Willoughby B. Laycock, each of whom serve on the Board. Through these experiences, Mr. B. Francis Saul II contributes leadership, real estate, governance and financial experience, as well as familiarity with the Company’s business, to the Board. | |||||||||||||||

| John E. Chapoton | Director since October 2002. Partner, Brown Investment Advisory since 2001. Partner in the law firm of Vinson & Elkins LLP from 1984 to 2000. Assistant Secretary of Treasury for Tax Policy 1981 to 1984. Former director of StanCorp Financial Group, Inc.* Through these experiences, Mr. Chapoton contributes investment, legal, public policy and public company experience to the Board. | |||||||||||||||

| D. Todd Pearson | 43 | Director since May 2023. President and Chief Operating Officer since May 2021. Executive Vice President - Real Estate from October 2019 to April 2021. Senior Vice President - Acquisitions and Development from 2017 to September 2019. Vice President - Acquisitions and Development from 2011 to 2016. Vice President - Director of Internal Audit in 2010. Director of Internal Audit from 2005 to 2009. Through these experiences, Mr. Pearson contributes public company, real estate, finance, accounting, development, construction and leadership experience to the Board. | ||||||||||||||

11

| Name | Age | Principal Occupation and Directorships | |||||||||||||

| Class Three Directors-Term Ends at 2026 Annual Meeting (Continued) | |||||||||||||||

| H. Gregory Platts | Director since March 2012. Mr. Platts retired from the National Geographic Society in 2011 after a 31-year career. He had been Senior Vice President and Treasurer since 1991, responsible for all investment and banking activities. Prior to joining the National Geographic Society in 1980, Mr. Platts served as a trust investment officer with the First American Bank in Washington, Through these experiences, Mr. Platts contributes finance, leadership, governance and public policy experience to the Board. | ||||||||||||||

| Age | |||||||||||||||

| Principal Occupation and Directorships | |||||||||||||||

| Class Two Directors-Term Ends at | |||||||||||||||

| George P. Clancy, Jr. | Director since March Through these experiences, Mr. Clancy contributes public company, real estate, finance, governance and leadership experience to the Board. | ||||||||||||||

| J. Page Lansdale | Director since June 2014.President and Chief Operating Officer Through these experiences, Mr. Lansdale contributes public company, real estate, design, development and construction and leadership experience to the Board. | ||||||||||||||

| Andrew M. Saul II | Director since June 2014. Mr. A. M. Saul II is the Chief Executive Officer and co-founder of Genovation Cars. Director of B. F. Saul Company since 2013. Trustee of B. F. Saul Real Estate Investment Trust since 2014. Mr. A. M. Saul II Through these experiences, Mr. A. M. Saul II contributes innovation and leadership experience to the Board. | ||||||||||||||

12

| Name | Age | Principal Occupation and Directorships | ||||||||||||||||

Vice Chairman since September 2023, Director since B. F. Saul Real Estate Investment Trust since June 2017 and has served as Vice Chair of the Board since January 2022. Ms. Lotuff has served as a member of the Board of Directors of Chevy Chase Trust Company and ASB Capital Management, LLC since December 2018 and has served as Vice Chair of each board since March 2022. Ms. Lotuff has previously served on and chaired the boards of several philanthropic, civic and non-profit organizations. Ms. Lotuff is the daughter of the Company’s Chairman and Chief Executive Officer, B. Francis Saul II, the sister of Andrew M. Saul II, a member of the Board, and the aunt of Willoughby B. Laycock, a member of the Board. Through these experiences, | ||||||||||||||||||

*Directorship in a publicly held company (i.e., a company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 and the rules and regulations issued thereunder (the “Exchange Act”) or subject to the requirements of Section 15(d) of the Exchange Act) or a company registered as an investment company under the Investment Company Act of 1940 during all or part of the time such person was a director of such company.

CORPORATE GOVERNANCE

Board of Directors

General. The Company is currently managed by a 12-member Board of Directors.Directors, which will be increased to 13 members as of the date of the annual meeting. The Board has adopted a set of corporate governance guidelines, which, along with the written charters for the Board committees described below, provide the framework for the Board’s governance of the Company. The corporate governance guidelines are available both on the Company’s website at www.saulcenters.com and in print free of charge to any stockholder who requests them. The Company has also adopted an ethical conduct policy that includes provisions ranging from legal compliance to conflicts of interest. All employees and directors are subject to this code. A copy of the Company’s ethical conduct policy is available on the Company’s website at www.saulcenters.com and in print free of charge to any stockholder who requests it.

Independence and Composition. The Articles and the NYSE listing standards each require that a majority of the Board of Directors be “independent directors,” as defined in the Articles and the NYSE listing standards.

The Board of Directors, upon the unanimous recommendation of the Nominating and Corporate Governance Committee, has determined that Messrs. Caraci, Chapoton, Clancy, Jackson, Noonan,Lansdale, Platts, Powell III and Sullivan III, representing a majority of the Board of Directors, are, and if elected Mr. Leffall III will be, “independent directors” as defined in the NYSE listing standards and the Articles. The Board made its determination based on information furnished by all directors regarding their relationships with the Company and research conducted by management. In addition, the Board consulted with the Company’s counsel to ensure that the Board’s determination would be consistent with all relevant securities laws and regulations as well as the NYSE listing standards.

Leadership Structure. Currently, Mr. B. Francis Saul II serves as the Chairman of the Board of Directors and Chief Executive Officer of the Company, and we dothe Company does not have a lead independent director. At this time, the Board believes that the Company and its stockholders are best served by having Mr. B. Francis Saul II serve as Chairman and Chief Executive Officer.

Mr. B. Francis Saul II’s tenure as Chief Executive Officer since the Company’s formation, his more than 45 years of experience leading the Saul Organization and his significant ownership interest in the Company uniquely qualify him to serve as both Chairman and Chief Executive Officer. In addition, the Board believes that Mr. B. Francis Saul II’s combined role as Chairman and Chief Executive Officer promotes unified leadership and direction for the Board and executive management, and his knowledge of the Company’s properties and business operations makes it appropriate for him to lead Board discussions.

13

The Company does not have a lead independent director, because the Board believes that it is currently best served without designating a single lead independent director. EightSeven of the 12 current members of our Board are independent under the NYSE listing standards and the Articles and, as required by the NYSE listing standards, the Audit, Compensation and Nominating and Corporate Governance Committees are composed solely of independent directors. In addition, the Board and each of these committees have complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. The Board also holds regularly scheduled executive sessions of only non-management directors in order to promote discussion among the non-management directors and assure independent oversight of management.

Meetings and Attendance. The Board of Directors met five times during the year ended December 31, 2017.2023. All of the directors currently serving on the Board of Directors, including the nominees, attended allat least 75% of the aggregate total number of meetings of (i) the Board of Directors and (ii) the committees of the Board of Directors thaton which he was eligible to attend.or she serves. The corporate governance guidelines provide that it is the responsibility of individual directors to make themselves available to attend scheduled and special Board and committee meetings on a consistent basis. All 1112 directors at the time of the 20172023 annual meeting of stockholders were in attendance at that meeting.

Risk Oversight. The Board is involved in risk oversight through direct decision-making authority with respect to significant matters and the general oversight of management by the Board and its committees. In particular, the Board administers its risk oversight function through (1) the review and discussion of regular reports from management, as well as auditors and other outside consultants, to the Board and its committees on the Company’s business, including risks that the Company faces in conducting its business, (2) the required approval by the Board (or a committee thereof) of significant transactions and other decisions and (3) the direct oversight of specific areas of the Company’s business by the Compensation,

Audit and Nominating and Corporate Governance Committees. The Board also relies on management to bring significant matters impacting the Company to its attention.

Pursuant to the Audit Committee’s charter, the Audit Committee is specifically responsible for reviewing with management, the independent auditor and the Company’s internal auditors any significant risks or exposures, discussing the guidelines and policies that govern the process by which the Company’s exposure to risk is assessed and managed by management and assessing the steps management has taken to minimize such risks to the Company.

While the Board believes its current leadership structure enables it to effectively oversee the Company’s management of risk, it was not the primary reason the Board of Directors selected its current leadership structure over other potential alternatives.

Interested Party Communications. The Board of Directors has adopted a process whereby interested parties can send communications directly to the directors. Any interested party wishing to communicate directly with the presiding director or with the non-management directors as a group, or with one or more directors, may do so in writing, by addressing their communication to the director or directors, c/o Saul Centers, Inc., 7501 Wisconsin Avenue, Suite 1500E, Bethesda, Maryland 20814-6522. All correspondence will be reviewed by the Company and forwarded to the director or directors.

14

Audit Committee

General. The Board of Directors has established an Audit Committee, which is governed by a written charter, a copy of which is available both on the Company’s website at www.saulcenters.com and in print free of charge to any stockholder who requests it. Among the duties, powers and responsibilities of the Audit Committee as provided in the Audit Committee charter, the Audit Committee:

•has sole power and authority concerning the engagement and fees of the independent registered public accounting firm;

•reviews with the independent registered public accounting firm the plans and results of the audit engagement;

•pre-approves all audit services and permitted non-audit services provided by the independent registered

public accounting firm;

•reviews the independence of the independent registered public accounting firm;

•review and approve in advance the appointment and/or replacement of the chief internal audit executive;

•reviews the adequacy of the Company’s internal control over financial reporting; and

•reviews accounting, auditing and financial reporting matters with the Company’s independent registered public accounting firm and management.

Independence and Composition. The composition of the Audit Committee is subject to the independence and other requirements of the Securities Exchange Act of 1934 and the rules and regulations promulgated by the SEC thereunder, which is referred to as the Exchange Act and the NYSE listing standards. Messrs. Caraci, Clancy Jackson, Noonan, and Platts currently are the members of the Audit Committee, with Mr. Clancy serving as Chairman.

The Board of Directors, upon the unanimous recommendation of the Nominating and Corporate Governance Committee, has determined that all current members of the Audit Committee meet the audit committee composition requirements of the Exchange Act and the NYSE listing standards and that Messrs. Clancy Jackson and Platts are “audit committee financial experts” as that term is defined in the Exchange Act.

Meetings. The Audit Committee met seven times in the year ended December 31, 2017.2023.

Nominating and Corporate Governance Committee

General. The Board of Directors has established a Nominating and Corporate Governance Committee, which is governed by a written charter, a copy of which is available both on the Company’s website at www.saulcenters.com and in print free of charge to any stockholder who requests it. As provided in the Nominating and Corporate Governance Committee charter, the Nominating and Corporate Governance Committee:

•identifies and recommends to the Board of Directors individuals to stand for election and reelection to the Board at the annual meeting of stockholders and to fill vacancies that may arise from time to time;

•develops and makes recommendations to the Board for the creation and ongoing review and revision of a set of effective corporate governance guidelines that promote the competent and ethical operation of the Company and any policies governing ethical business conduct of the Company’s employees or directors; and

•makes recommendations to the Board of Directors as to the structure and membership of committees of the Board of Directors.

Selection of Director Nominees. The corporate governance guidelines provide that the Nominating and Corporate Governance Committee endeavor to identify individuals to serve on the Board who have expertise that is useful to the Company and complementary to the background, skills and experience of other Board members. The Nominating and Corporate Governance Committee’s assessment of the composition of the Board includes: (a) skills - knowledge of corporate governance, business and management experience and background, real estate experience and background, accounting experience and background, finance experience and background, and an understanding of regulation and public policy matters, (b) characteristics - ethical and moral standards, leadership abilities, sound business judgment, independence and innovative thought, and (c) composition - diversity, age and public company experience. The principal qualification for a director is the ability to act in the best interests of the Company and its stockholders. The Company’sCompany's corporate governance guidelines provide that the Nominating and Corporate Governance Committee should, in determining the composition of the Board, include diversity as one of the many factors it considers. Both the Board and The Company does not have a formal policy on diversity, however,

15

the Nominating and Corporate Governance Committee conduct annual self-evaluations,assesses its effectiveness in the course of which complianceaccounting for diversity, along with the corporate governance guidelines is reviewed.other factors considered when identifying director nominees, when it annually evaluates the performance of the Board of Directors.

The Nominating and Corporate Governance Committee also considers director nominees recommended by stockholders. In accordance with the Company’s Bylaws and the Exchange Act, any proposal from stockholders regarding possible director candidates to be elected at a future annual meeting or proposals for any other matters must be received by the Company at 7501 Wisconsin Avenue, Suite 1500E, Bethesda, Maryland 20814-6522, Attn: Secretary not less than 60 nor more than 90 calendar days before the first anniversary of the previous year’s annual meeting, provided, that in the event that the date of the upcoming annual meeting is advanced by more than 30 days or delayed by more than 60 days from the first anniversary date, to be timely delivered, the proposal must be received not earlier than the 90th day prior to the upcoming annual meeting and not later than the close of business on the later of the 60th day prior to the upcoming annual meeting or the 10th day following the day on which public announcement of the date of the upcoming annual meeting is first made. The deadline for submissions of proposals for the 20192025 annual meeting can be found under the section captioned “Proposals for Next Annual Meeting.”

Please note that proposals must comply with all of the requirements of Rule 14a-8 under the Exchange Act. In addition, any proposals must include the following:

•the name and address of the stockholder submitting the proposal, as it appears on the Company’s stock transfer records, and of the beneficial owner thereof;

•the number of shares of each class of the Company’s stock which are owned beneficially and of record by the stockholder and the beneficial owner;

• the date or dates upon which the stockholder acquired the stock;

•the reasons for submitting the proposal and a description of any material interest the stockholder or beneficial owner has in submitting the proposal; and

•all information relating to the director nominee that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a director nominee and to serving as a director if elected).

The Chairman of the Annual Meetingannual meeting shall have the power to declare that any proposal not meeting these requirements is defective and shall be discarded.

The Nominating and Corporate Governance Committee evaluates director candidates recommended by stockholders in the same manner that it evaluates director candidates recommended by the directors or management.

Independence and Composition. The NYSE listing standards require that the Nominating and Corporate Governance Committee consist solely of independent directors. From January 1, 2017 through March 16, 2017, Messrs. GrosvenorCaraci and Jackson werePlatts currently are the members of the Nominating and Corporate Governance Committee, with Mr. GrosvenorPlatts serving as Chairman. From March 17, 2017 through March 15, 2018, Messrs. Jackson and Noonan were the members of the Nominating and Corporate Governance Committee, with Mr. Jackson serving as Chairman. Effective March 16, 2018, Messrs. Noonan and Platts became the members of the Nomination and Corporate Governance Committee, with Mr. Noonan serving as Chairman.

The Board of Directors, upon the unanimous recommendation of the Nominating and Corporate Governance Committee, has determined that all current members of the Nominating and Corporate Committee are “independent directors,” as defined in the NYSE listing standards.

Meetings. The Nominating and Corporate Governance Committee met once induring the year ended December 31, 2017.2023.

16

Compensation Committee

General. The Board of Directors has established a Compensation Committee, which is governed by a written charter, a copy of which is available both on the Company’s website at www.saulcenters.com and in print free of charge to any stockholder who requests it.

•approving and evaluating the compensation plans, policies and programs for the Company’s officers;

•making recommendations to the Board with respect to the compensation of directors; and

•approving all awards to any officer under the Company’s stock option and equity incentive plans.

The Compensation Committee also serves as the administrator of the Company’s 2004 Stock Plan.equity incentive plans.

Role of Others in Compensation Determinations. The Compensation Committee considers the recommendations of the Chairman and Chief Executive Officer when determining the compensation of the directors and executive officers other than the Chairman and Chief Executive Officer. NeitherFrom time to time, the Compensation Committee noror the Company retainsmay retain compensation consultants.

Delegation of Authority by the Committee. Although the Chairman and Chief Executive Officer may recommend to the Compensation Committee equity compensation awards for the executive officers other than the Chairman and Chief Executive Officer, the Compensation Committee approves the grant of all such awards to executive officers under the Company’s 2004 Stock Plan.

The Company’s executive compensation programs and philosophy are described in greater detail under the section entitled “Compensation Discussion and Analysis.”

Independence and Composition. The NYSE listing standards require that the Compensation Committee consist solely of independent directors. From January 1, 2017 through March 16, 2017, Messrs. GrosvenorCaraci and Jackson werePlatts currently are the members of the Compensation Committee, with Mr. GrosvenorPlatts serving as Chairman. From March 17, 2017 through March 15, 2018, Messrs. Jackson and Noonan were the members of the Compensation Committee, with Mr. Jackson serving as Chairman. Effective March 16, 2018, Messrs. Noonan and Platts became the members of the Compensation Committee, with Mr. Noonan serving as Chairman.

The Board of Directors, upon the unanimous recommendation of the Nominating and Corporate Governance Committee, has determined that all current members of the Compensation Committee are “independent directors,” as defined in the NYSE listing standards.

Meetings. The Compensation Committee met twicethree times in the year ended December 31, 2017.2023.

Executive Committee

General. The Board of Directors has established an Executive Committee. The Executive Committee, which is not governed by a written charter, has such authority as it is delegated by the Board of Directors and advises the Board of Directors from time to time with respect to such matters as the Board of Directors directs.

Independence and Composition. The Exchange Act and the NYSE listing standards do not require that the Executive Committee consist of any independent directors. Messrs. Caraci Jackson, and B. Francis Saul II currently are the serving members of the Executive Committee, with Mr. B. Francis Saul II serving as Chairman.

Meetings. The Executive Committee did not meet during the year ended December 31, 2017.2023.

Ethical Conduct Policy and Senior Financial Officer Code of Ethics

The directors, officers and employees of the Company are governed by the Company’s Ethical Conduct Policy. The Company’s Chairman and Chief Executive Officer, Senior Vice President-Chief Financial Officer, Treasurer and Secretary, SeniorExecutive Vice President-Chief Accounting Officer and Treasurer, and Senior Vice President-Controller are also governed by the Code of Ethics for senior financial officers. The Ethical Conduct Policy and the Code of Ethics are available both on the Company’s website at www.saulcenters.com and in print free of charge to any stockholder who requests them. Amendments to, or waivers from, a

provision of the Ethical Conduct Policy or the Code of Ethics will be posted to the Company’s website within four business days following the date of the amendment or waiver.

17

Compensation Committee Interlocks and Insider Participation

Mr. Philip D. Caraci was an officer of the Company from 1993 until his retirement in 2003. None of the other current members of our Compensation Committee serves,serve, or has in the past served, as one of ourthe Company’s employees or officers. Two of the Company's executive officers, Mr. B. Francis Saul II and Ms. Christine N. Kearns,one of the Company's directors, Mr. H. Gregory Platts, currently serve, and in the past year have served, as members of the Compensation Committee of Chevy Chase Trust Company, where

Mr. B. Francis Saul II is anChairman. Ms. Christine N. Kearns, a former executive officer.officer, previously served as a member of the Compensation Committee of Chevy Chase Trust Company, where she also served as a Vice Chairman of the Board of Directors. Ms. Kearns retired effective December 31, 2023. Effective January 1, 2024, one of the Company's directors, Patricia Saul Lotuff, became a member of the Compensation Committee of Chevy Chase Trust Company, where she currently serves as a Vice Chairman of the Board of Directors.

Compensation of Directors

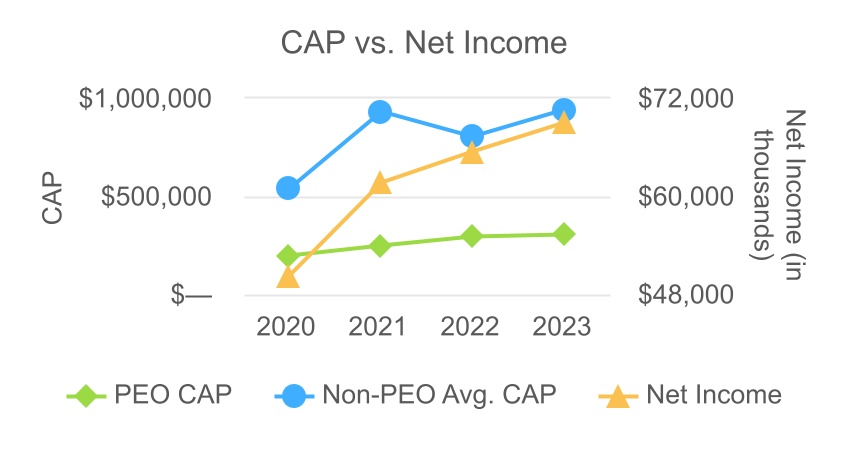

On the first business day following the conclusion of each regular annual meeting of the Company’s stockholders, commencing with the 2024 annual meeting, each non-employee director who shall continue serving as a member of the Board thereafter shall receive an award of 2,000 restricted shares of Common Stock (each, an “Annual Award”) under the 2024 Plan, if the 2024 Plan is approved by stockholders.